|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Current Refinance Rates: A Complete Beginner's Guide to Navigating OptionsUnderstanding current refinance rates is crucial for homeowners looking to reduce their mortgage payments or access home equity. This guide will walk you through the essentials of refinancing, providing clarity on rates, types, and factors influencing them. What Are Refinance Rates?Refinance rates refer to the interest rate applied to a new loan taken to replace an existing mortgage. These rates can vary based on market conditions, loan types, and your credit profile. Fixed vs. Variable RatesChoosing between fixed and variable rates depends on your financial goals and risk tolerance.

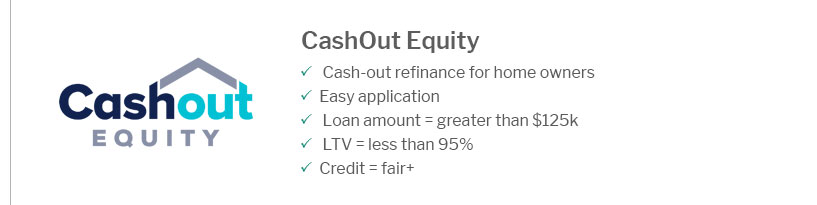

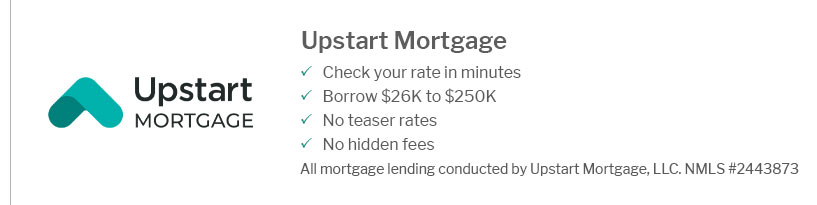

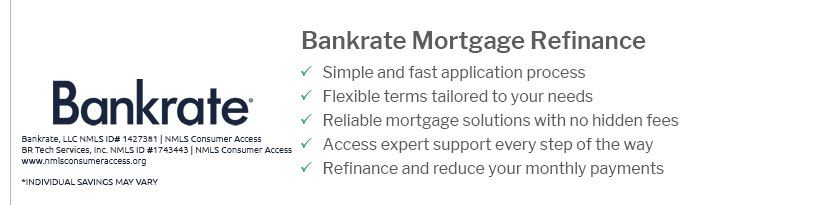

Factors Affecting Refinance RatesSeveral factors can influence the refinance rates you receive. Understanding these can help in securing favorable terms. Credit ScoreYour credit score plays a significant role in determining your eligibility and the rates offered. Higher scores typically result in lower rates. Loan-to-Value Ratio (LTV)The LTV ratio compares your loan amount to the appraised value of your property. Lower LTV ratios are preferable and can lead to better rates. Learn more about specific refinance options, such as an fha loan alabama, which may offer competitive rates and flexible terms. Types of Refinance LoansUnderstanding the different types of refinance loans can help you choose the best option for your needs. Rate-and-Term RefinanceThis option allows you to change the interest rate or term of your existing loan, potentially lowering monthly payments. Cash-Out RefinanceAccess home equity by replacing your existing loan with a larger one, receiving the difference in cash. Use it wisely to avoid financial pitfalls. To unlock your home's potential, consider applying for a Home Equity Line of Credit. You can apply for heloc and access funds for major expenses or investments. FAQWhat is a good refinance rate today?A good refinance rate varies based on market trends and individual factors like credit score. Checking with multiple lenders can help you find competitive offers. How often do refinance rates change?Refinance rates can change daily based on economic indicators, lender policies, and market conditions. Can I refinance with bad credit?Refinancing with bad credit is possible but may result in higher rates. Consider improving your credit score or exploring FHA refinance options. https://www.rocketmortgage.com/mortgage-rates

... current mortgage rate is to let us estimate it based on your unique details. Estimate My Rate. Purchase Rates Refinance Rates - 30-Year Fixed. Rate7.125%. https://www.bankofamerica.com/mortgage/refinance-rates/

Today's competitive refinance rates ; 30-year - 6.750% - 6.950% ; 20-year - 6.625% - 6.863% ; 15-year - 5.875% - 6.165% ; 10y/6m - 6.875% - 7.164% ; 7y/6m - 6.625% - 7.069%. https://www.zillow.com/refinance/

The current average 30-year fixed refinance rate fell 3 basis points from 7.08% to 7.05% on Tuesday, Zillow announced. The 30-year fixed refinance rate on March ...

|

|---|